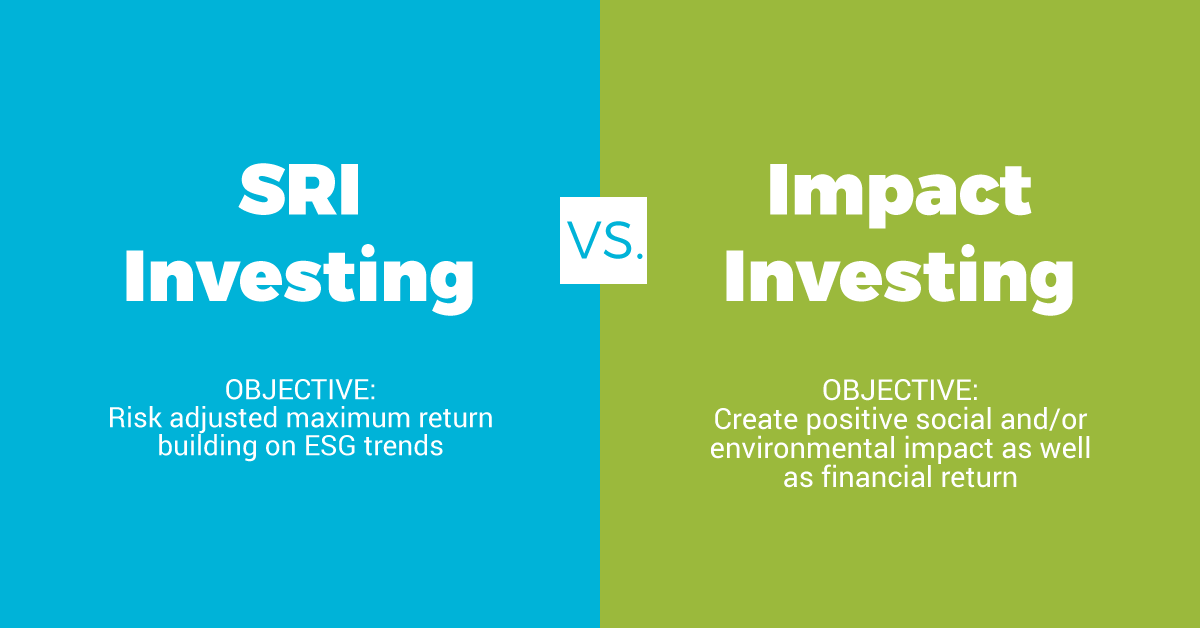

These terms are often used freely, but they aren’t interchangeable. It is essential to understand—and be able to explain—the differences between socially responsible investing and impact investing so investors can make informed decisions.

In their most basic forms, socially responsible investing and impact investing are very similar. They both seek to consider financial return and social good to bring about a social change. Beyond this, though, socially responsible investing and impact investing begin to branch off in different directions.

A fundamental difference between socially responsible investing and impacting investing is in their screening – negative vs. positive.

Socially responsible investing typically involves an investor’s decision to avoid investing in companies or organizations that do not align with their goals or values – i.e., negative screening. Socially responsible investing can be a solid choice for individuals who want to be sure their money isn’t supporting companies that they perceive to have negative effects on the world. For example, an investor may say they don’t want any of their investments to support organizations that deal in tobacco, fire arms, or are known to be major polluters. Their portfolios can then be screened to filter out those “offenders.”

Impacting investing is a proactive approach whereby investors actively seek investments or organizations that will have a beneficial impact or outcome – i.e., positive screening. For example, an impact investor may choose to invest directly in a company that builds affordable housing, or they might opt to invest in a small business making environmentally-friendly products. Advisors work with investors to find investments which align with the investors’ impact goals and that have a positive outcome.

At CCM, we’ve been focused on impact investing since 1999. Our fixed income impact investing strategy uses a pioneering research method, which combines impact research with financial analysis. Conducting a use of proceeds analysis is paramount to our investment process; we don’t employ negative screening. In addition to traditional financial reporting, our clients receive detailed impact reports outlining the impact initiatives being financed with their invested capital.

{{cta(‘ca90d1b8-e5fb-4c39-a1ae-c55e9ea55ff0′,’justifycenter’)}}