The belief that impact/ESG investing could potentially mean sacrificing returns has been a longstanding concern of advisors and investors. While most people like the idea of investing in companies generating positive social and environmental impacts, they are often cautious of doing so if they believe that it could negatively affect their financial returns. Fortunately, data produced over the past decade has confirmed that impact/ESG investing and strong returns can, and often do, go hand-in-hand.

Image source: NetImpact.org

- In 2015, a study by Friede, Busch, and Bassen found a non-negative relationship between environmental, social, and governance (ESG) factors and corporate financial performance in around 90% of over 2,000 empirical studies dating all the way back to 1970.1

- The same year, the Morgan Stanley Institute for Sustainable Investing conducted a study examining the performance of 10,228 open-end mutual funds and 2,874 separately managed accounts since the Global Financial Crisis. The results were positive, showing that investment vehicles with sustainable mandates usually met and often exceeded the performance of traditional investments.2

- In November of 2017, the Global Impact Investing Network (GIIN) produced a report titled “GIIN Perspectives: Evidence on the Financial Performance of Impact Investments.” The report analyzed the financial performance of investments across common asset classes. One of the report’s conclusions is that investors wanting to pursue impact investments can achieve the same rates of returns of traditional investments, but the range of returns varies considerably (about as much as conventional investments). Therefore, manager selection is critical. 3

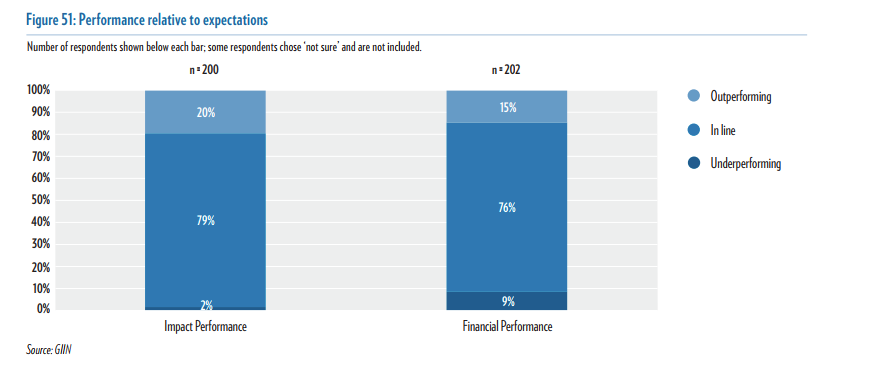

Other organizations such as Cambridge Associates, the Wharton School at the University of Pennsylvania, and McKinsey & Co. have conducted similar studies that demonstrate the success of impact/ESG/SRI investments relative to traditional benchmarks and investment peer groups. The GIIN has also conducted surveys such as their 2017 Annual Impact Investor Survey which shows how impact investments can perform in line with or outperform impact investors’ expectations, as illustrated in the graph below.

Looking forward, we anticipate even more studies emerging disproving this myth especially as the universe of impact/ESG investments continues to grow.

For those interested, Bankrate, Inc. recently created a guide that provides insight for beginner investors looking at socially responsible investing.

{{cta(‘0f06525f-e77b-4b70-92f8-128bb5d15e37′,’justifycenter’)}}

2https://www.morganstanley.com/ideas/sustainable-investing-performance-potential.html

3https://thegiin.org/research/publication/financial-performance