According to a recent Fundfire interview with Chris Hyzy, CIO for U.S. Trust and Merrill Lynch, his firm’s most recent annual survey confirms that an increasing number of high net worth individuals are pairing their investments with their beliefs by allocating to impact/ESG investments.1 Mr. Hyzy notes that the increase of interest in impact/ESG investing has been “a consistent trend over the years of the survey.. [with] the shift going up in all demographics, from boomers on down to millennials.” 2

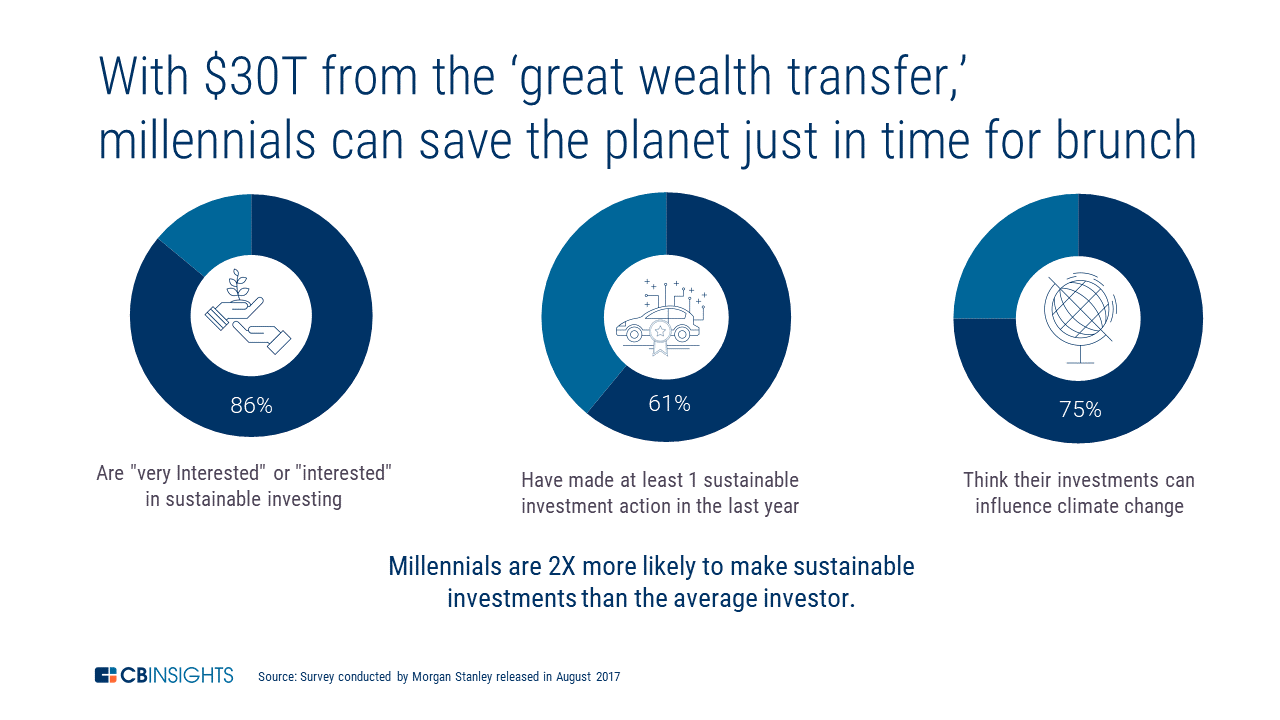

What seems to be noteworthy from the Hyzy interview is the high rates of actual investment participation. Mr. Hyzy notes that more than 50% of high net worth Millennials are actively investing in impact/ESG options. Recent data from analytics provider CB Information Services backs this up, with 61% of Millennials surveyed by Morgan Stanley having made at least one sustainable investment action in the past year.3

Image Source: CBInsights

While interest around impact/ESG investing from Millennials has been a strong theme over the past few years, older generations of investors tend to be warier. However, the overall awareness has increased dramatically for all demographics as Hyzy mentions that “most are starting to understand that impact investing is not just a tag line or something that’s interesting”. He goes on to imply that in 2018 there was a massive shift in the belief system that investors are able to get good returns while investing in good. 4

The adoption of impact investing has been a growing trend in wealth management, and while still in the early stages, the actions of younger investors and adapting views of all generations indicates that this trend will not be slowing down any time soon.

{{cta(‘0f06525f-e77b-4b70-92f8-128bb5d15e37′,’justifycenter’)}}

1,2,4 Fundfire website (paid subscription to see content)

3 https://www.cbinsights.com/research/impact-investing-millennials-fintech/