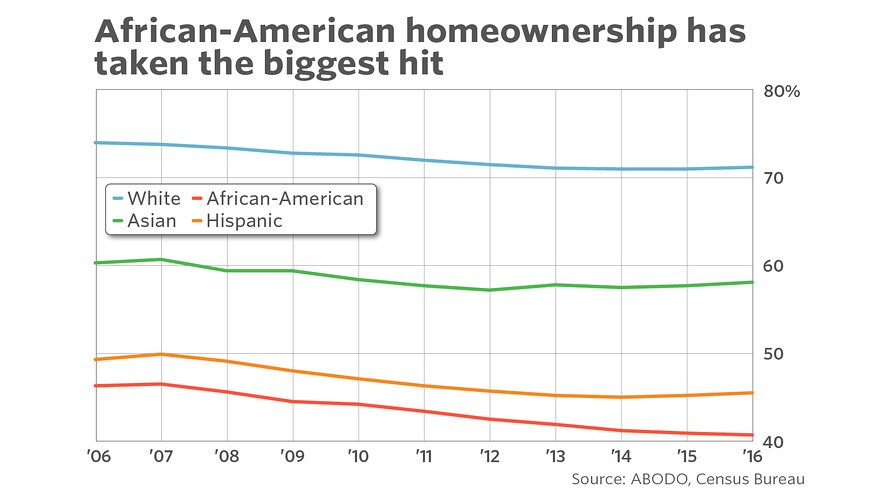

Racial inequalities in the housing market are still quite deep. In the decade from 2006 – 2016, African-American homeownership declined nearly 6 percentage points which is more than any other racial group and is double the decline among whites. African-Americans began that 10-year period with the lowest homeownership rate and at the end of the year, they still had the lowest.

In addition to the imbalance in homeownership, African-Americans receive a far smaller share of mortgages, relative to their share of the population, than other racial groups. They represent 13% of the population but only received 6% of mortgages in 2016.1 If they are able to borrow, they’re often charged higher rates with less favorable terms than other racial groups.

At CCM, we are committed to doing our part to bring more equality to the imbalances in minority homeownership. Two of our 17 impact themes positively benefit affordable homeownership and minority neighborhoods. Last year, we announced the addition of another positive gender lens component to our fixed income impact investing strategy through customized mortgage pools that are providing capital exclusively to low- and moderate-income women borrowers. This year, we are looking to add custom mortgage pools providing capital to minority borrowers along with other investments positively influencing racial equality.

1 Source: Home Mortgage Disclosure Act

{{cta(‘b70a727f-0b6c-4ec9-b014-e6f039115aeb’,’justifycenter’)}}