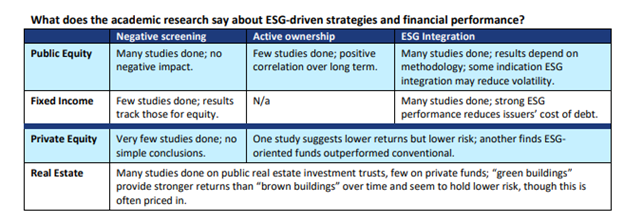

Cornerstone Capital Group recently released a research report that takes a fresh look at investment performance of sustainable and impact strategies by asset class. Their research includes a sampling from 2,200 reports published over the past few decades with results confirming that “social screens do not compromise investment performance”. Their review also highlights that the effect of sustainable and impact strategies on a portfolio will depend upon the asset class, investment style, and especially the skill and expertise of the manager.1

Source: Cornerstone Capital Report

Other general findings of the report include:

- Sustainable investing in the equity and fixed income asset classes is fully consistent with fiduciary duty, and investors in these asset classes can and should expect to achieve competitive returns relative to convention investment vehicles.

- For fixed income and real estate, applying ESG criteria is associated with reduced risk relative to the market. There is some evidence for this in public equity as well.

- Incorporation of ESG criteria reduces the number of managers and strategies that are available to asset owners. Therefore, due diligence on manager skill, fees and other criteria may be more important for sustainable investors.

We encourage you to read the entire report which includes more details in impact/ESG investing by asset class along with more findings: https://cornerstonecapinc.com/blog/wp-content/uploads/Sacrifice-Nothing_A-Fresh-Look-at-Performance.pdf