In this week’s blog, Andy Kaufman, CCM’s chief investment officer, shares his 2019 economic recap highlighting three key themes: recession speculation, international trade, and U.S. politics.

- Recession speculation

The economy continued its historic expansion, but it appears to be in the latter stages of the business cycle. A combination of interest rate cuts by the Federal Reserve, strong employment and strong consumer spending continue to help boost the economy.For the first time since 2008, the Federal Reserve cut interest rates for a total of three times in 2019 to current levels of 1.50%. The unemployment rate dropped to 3.5% in November, matching a half-century low. Wages rose a solid 3.1% in November compared with a year earlier.1 With all being said, the risk of volatility may increase as the U.S. economy reaches the latter stages of the business cycle as well as the looming presidential elections in 2020.

- International Trade

The trade war between the United States and China increased market volatility during the year. Tariffs and the threat of additional tariffs weighed on both economies which ultimately helped get to the first phase of a trade deal in mid-December. Though the details are still limited, and both parties have yet to sign the agreement, the fact that more tariffs were not enacted is a market win. Here are the details provided by the Office of the United States Trade Representative.“The United States and China have reached an historic and enforceable agreement on a Phase One trade deal that requires structural reforms and other changes to China’s economic and trade regime in the areas of intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange. The Phase One agreement also includes a commitment by China that it will make substantial additional purchases of U.S. goods and services in the coming years. Importantly, the agreement establishes a strong dispute resolution system that ensures prompt and effective implementation and enforcement. The United States has agreed to modify its Section 301 tariff actions in a significant way.”2

In addition to the U.S./China trade war, Brexit also added to market volatility. Speculations on trade agreements and market positions continue as the UK looks to leave the European Union (EU) on January 31, 2020.

- U.S. Politics

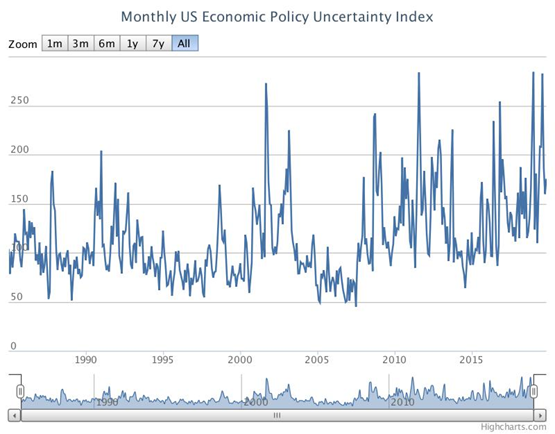

There was a lot of negative headlines that took place in 2019 in U.S. politics, from anti-immigration policies, to escalating trade wars, to President Trump’s impeachment. The historic impeachment didn’t shake the financial markets; however, with it now moving forward to the Senate, we anticipate there could be some unease and increased volatility. Political uncertainty is running at near historical levels after rising to just below an all-time high in August.3 President Trump’s ongoing series of tweets and news headlines create swift reactions with investors causing the financial markets to react to an unusual degree. We believe this will continue into the new year, especially given it’s an election year.

Figure 1 Source: Economic Political Uncertainty 4

1 http://www.ncsl.org/research/labor-and-employment/national-employment-monthly-update.aspx

2 https://ustr.gov/about-us/policy-offices/press-office/press-releases/2019/december/united-states-and-china-reach

3 https://www.marketwatch.com/story/stock-investors-cant-ignore-politics-because-its-the-only-reason-a-recession-is-a-threat-2019-10-22

4 https://www.policyuncertainty.com/index.html