In this week’s blog, Andy Kaufman, CCM’s chief investment officer, shares his thoughts on the financial markets in 2020 and the long-term outcomes.

The year 2020 will go down in history for many reasons. The global pandemic will be the headline along with extreme market volatility, political discourse, and racial inequality. There will most likely be many long-term implications of the decisions, policies, and innovations that took place in 2020 and they will likely echo for decades to come. The way we educate, collaborate, and do business as a result of the pandemic has altered our way of life and I anticipate many businesses remaining virtual for the foreseeable future. The methods for purchasing goods and services were already evolving prior to 2020 and hit hyper drive due to quarantines, social distancing, and lock downs.

The actions taken by the Federal Reserve (the Fed) on the capital markets in 2020 were profound and will likely set a precedent that market participants may come to expect in future downturns. The quantitative programs that have ballooned the Fed’s balance sheet are not just made up of treasuries and agency MBS – they include equity holdings of ETFs with corporate and high yield bonds as underlying assets. One of my favorite quotes heard last year was “everyone is a capitalist when the market is going up, and everyone is a socialist when the market is going down”. While this is of course not 100% accurate, the markets reliance on monetary intervention appears to be moving the needle further away from free markets.

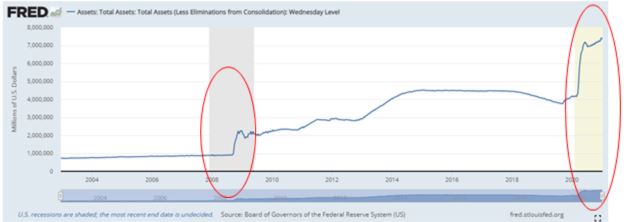

The Fed’s and other central banks actions were necessary but what will be the expectation when the next downturn occurs? If we look at quantitative easing (QE) during the great recession compared to 2020 (in the chart below), we see it was not a linear relationship between capital needed to calm the market. Therefore, the question becomes, at what point and for what future event will quantitative easing become too big? Quantitative easing generally leads to short-term benefits with the risk of exacerbating long-term problems.

Driving interest rates to historical low levels and subsequently, equities to all-time highs proved to be effective tools and outcomes; however, can they backfire creating a market that is expecting a bailout at any cost? The Fed made minimal progress unwinding QE Infinity from 2013 and 2019. What will happen in 2021 and beyond from the Fed’s stimulus in 2020?

There will be many debates as to the Fed’s actions in 2020 and how it will likely impact the financial markets in the coming years. One thing seems to be certain though – if the Fed had not acted, the markets would almost certainly be lower, possibly in a catastrophic way.

If 2020 has taught us anything, it is that human ingenuity is still alive and well. While mathematical relationships may give us cause for concern down the road, the human spirit gives us hope to tackle whatever challenge is in front of us – in the market or otherwise.

Cheers to a brighter future,

Andy