The Global Impact Investing Network (GIIN) is a nonprofit organization that aims to spread awareness and increase effectiveness of impact investing worldwide. The GIIN builds critical infrastructure and supports activities, education, and research that helps accelerate the development of a coherent impact investing industry.1 Every year, GIIN releases their Annual Impact Investor Survey and creates a report based on the results. This year’s report presents findings from 266 of the world’s top impact investors. This was the most respondents GIIN has ever received making this the most comprehensive and conclusive assessment of the impact investing market.

We wanted to share in this week’s blog a few key findings.2

- The impact investment industry is very diverse. There are various types of organizations that conduct impact investing including fund managers, banks, and family offices. Moreover, there are many impact areas people invest in such as environmental sustainability, social welfare, or both!

- The impact investment market is growing and maturing. Respondents of the survey grew their impact investing assets under management by over $32 billion since 2014. In 2018 alone, over $33 billion was invested into more than 13,000 impact investments. Clearly, this market is growing at an increasing rate and is spreading to more sectors than ever.

- Impact measurement and management is central to investors’ goals and practices. More than 60% of investors specifically track their investments performance to the United Nations’ Sustainable Development Goal (SDGs), driven by a desire to integrate into a global development paradigm.

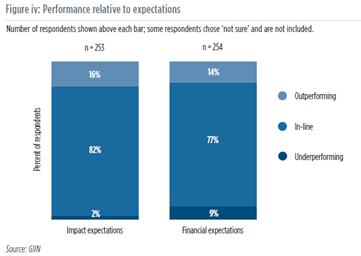

- Over 90% of respondents reported performance in line with or exceeding both their impact and financial expectations. It is great to see this figure so high and that the myth is finally being dispelled that impact investing requires a sacrifice in returns.

There was one final result that stood out to us. The survey concluded saying that people think impact investing will change the fundamental purpose of finance in society. Considering aspects such as sustainability, affordability, and simply helping a community could become the new normal. Instead of focusing on making money, investors can also focus on making a meaningful investment alongside a financial return. Thanks to the GIIN report, it allows investors to see the many benefits and positive outcomes that can result from making impact investments.

2 https://thegiin.org/research/publication/impinv-survey-2019