The Global Impact Investing Network’s (GIIN) “State of Impact Measurement and Management Practice” was published earlier this week with its second edition reflecting the increased sophistication and maturation of impact measurement and management (IMM) practices. Its first edition was published in 2017 and collected data from 169 impact investing organizations. This year’s report is the result of 278 impact investors answering questions about how they measure, manage, and report their impact1.

Here are some of the report’s key findings2:

- Measuring and managing impact results is important

Although impact investors may pursue various impact objectives, IMM is critical for both impact and business reasons. One hundred percent of respondents in the report said that understanding where they are making progress towards their impact goals are ‘very’ or ‘somewhat’ important.

- The integration of IMM has strengthened within investment processes

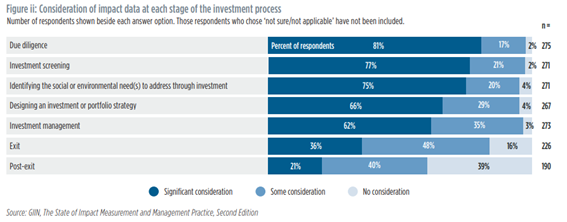

There has been significant progress in understanding and integrating IMM into investment processes. IMM responsibilities, which include practice and reporting, have now been incorporated among investment teams and/or senior leadership. Moreover, 50 percent of respondents now have full-time employees dedicate to IMM. The stage of the investment process in which IMM is being integrated still varies as shown in the chart below.

- Increased insight into impact performance

Nearly universally, respondents report on their impact performance and most commonly this is done through impact reports. However, gaps do still exist in the availability of market-level insights and comparable impact results. One of the key challenges facing the market is a lack of transparency on impact performance.

- IMM requires resources

On average, impact investors spend an estimated 12 percent of their company’s total budget on IMM-related activities. The greatest share of this is spent on data collection and reporting. IMM requires resources whether it’s staff time or from the budget. That being said, it also generates additional business value for both investors and investees.

The GIIN is convinced that strong focus on impact performance will lay an essential foundation for long-term, sustainable growth in impact investing. We agree and look forward to more reports from GIIN on IMM as the industry continues to evolve. If you would like to access the full report, click here.

1https://thegiin.org/research/publication/imm-survey-second-edition