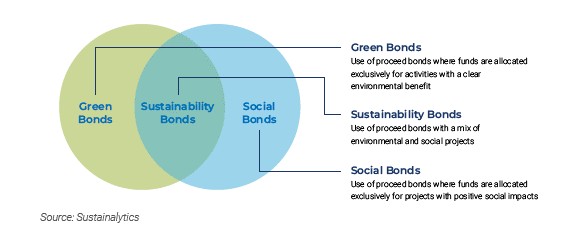

In recent years, the number of issuers coming to market with corporate debt offerings that look to have environmental and/or social impact outcomes has significantly increased. Sometimes labeled as green bonds, sustainability bonds, or social bonds, these issues may fit within investors’ requirements for impact alignment.

More recently, another category has been added to impact corporate bonds called sustainability-linked bonds (SLBs), which is any type of instrument for which the financial and/or structural characteristics can vary depending on whether the issuer achieves predefined sustainability objectives.

A recent report from S&P Global Ratings shows that global issuance of sustainable bonds — including green, social, sustainability, and sustainability-linked bonds — will surpass $1.5 trillion in 2022.

CCM began managing its core fixed income impact investing strategy in 1999, long before the terms “impact investing,” “sustainable investing,” “green bonds,” and “ESG investing” were coined. The strategy historically had limited exposure to the corporate bond sector given the limited data and metrics available on the use of proceeds, issuer-specific impact and mission-driven goals, and sustainability-linked outcomes, but that has changed in recent years with the growth of impact corporate bonds. We have seen continued growth in the space thus increasing the allocation in our portfolio within the past 5 years.

We anticipate ongoing development and evolution in this space and recently wrote a report, The Growth of Impact Corporate Bonds, that goes into more detail on impact corporate bonds, including case studies of the types of impact corporate debt we have purchased by sector and how each bond meets our impact and ESG investing criteria.