Adoption of Sustainable Investing (SI) strategies, or those that integrate Environmental, Social and Governance (ESG) goals, has seen considerable growth in defined contribution (DC) plans. This growth has been primarily fueled by an increased appetite from participants, interest from plan sponsors to align DC menus with their corporate values, and a growing set of investment capabilities that fit the performance needs and values of investors.1

Millennials are especially likely to ask for, and participate in, impact and ESG investment options in their investment portfolios and in their 401k plans. Bloomberg reported earlier this year to Pensions & Investments that within its own employees’ $2.5B 401(k) plan, Millennials are the largest identifiable group that has elected to participate in the plan’s ESG-focused fund.2 By simply observing the volume of people using Bloomberg terminals to conduct research on impact and ESG funds, Bloomberg executives determined there was a strong demand for these products, which was confirmed by conversations with employees. Outside of the standard target-date funds and qualified default funds, Bloomberg noted that the lone ESG fund on their platform now has a “nice percentage” of assets.3

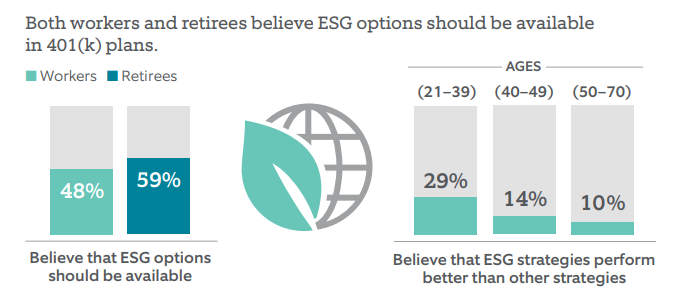

In a 2017 study conducted by Northern Trust Asset Management, 48% of workers and 59% of retirees share the belief that ESG options should be available in 401(k) plans and almost 10% already invest in these types of strategies. A key takeaway is that by aligning values with actionable investments, plan sponsors can meet the demands of current and future participants.4

Source: Northern Trust Asset Management

The ongoing interest in impact/ESG investing should eventually carry through to 401(k)s. We agree with some of the largest asset management firms that see ESG as a growth engine for retirement assets despite the U.S. Labor Department urging retirement plan sponsors to use caution in this area.5 The growth in the space continues to climb upward and we are excited to see where it’s headed.

{{cta(‘c6a8e09a-e897-4e3c-8219-42e2c097f5ae’,’justifycenter’)}}

1https://401kspecialistmag.com/why-sponsors-include-sustainable-investing-in-401k-menus/

2,3http://www.pionline.com/article/20180207/ONLINE/180209884/millennials-embrace-esg-option-in-bloombergs-401k-plan

4https://www.northerntrust.com/documents/presentations/dc-participant-survey-2017.pdf?bc=25281913

5https://www.bloomberg.com/news/articles/2018-06-13/blackrock-wells-fargo-are-said-to-push-esg-funds-for-401-k-s